Finseta: taking market share from the big banks.

Overview

Finseta is a currency exchange and payments business which offers multi-currency accounts to businesses and individuals. They predominantly handle higher value transactions, such as the purchase of a business or property, or those transactions with a higher compliance burden that larger banks are unwilling to handle.

Why the opportunity exists

Finseta’s share price is down 36% for the year. Due to the size of the business, there is not the same level of coverage available as some other companies that I follow, but from trawling through message boards, articles, and with some common sense, it is possible to get a decent idea of what investor’s frustrations are.

Lower than expected revenue growth – The company issued a trading update in January 2025 which gave guidance on revenue growth of 17% for the year. Despite this still being a healthy level of growth, it is significantly lower than the previous numbers posted by the group and caused the share price to decline by roughly 14% in a day.

Declining margins – Finseta’s most recent H1 trading update reported declining gross margins, 62% compared to 65.7% during the prior period, and lower adjusted EBITDA margins of £0.3m, compared to £0.8 the same period last year.

Economic uncertainty – Given the company’s focus on higher value transactions, it has been affected by the current economic uncertainty, particularly in international real estate. This is evident in changes to the revenue split in the most recent H125 period, with revenue from private clients falling from 60% to 42%.

FX market volatility – The current currency market volatility, particularly for the US dollar, is causing individuals and businesses to delay certain transactions. Finseta has reported that this is particularly relevant for larger transactions such as property, which customers have looked to delay until the second half of the year.

Investment Summary

A large and growing end market – The global cross-border payments market is growing fast and is expected to reach a total size of $194 trillion by 2032. Underpinning this growth are increasing levels of international trade, growth in global e-commerce, and improvements in the technology and processes supporting international transactions.

Operating in an area that banks don’t want to touch – Within the cross-border payments landscape, the market can be split between corporate payments, and the ‘low value’ segment of the market, comprising small B2B, C2B, C2C and B2C transactions. Whilst these low value segments account for less than 10% of total flows, they represent close to 33% of transaction revenue for Money Transfer Operators (MTOs). These payments are generally smaller and more complex than corporate payments, and banks are therefore often willing to forgo them.

A unique approach to client acquisition – Unlike other fintechs, Finseta does not cold call customers. Instead, they rely on what they call their introducer network; this is a network of lawyers, accountants and property agents who refer customers to Finseta in exchange for a fee. Because these customers are recommended directly, Finseta doesn’t have to compete with peers on price and can therefore maintain a take rate that is above that of their competitors.

High-touch customer experience – Unlike most of the market, who have transitioned to online only business models, Finseta has looked to move in the opposite direction. By focusing on providing a higher level of customer service, they have been able to appeal to a different customer base; these clients often have more complex requirements and therefore value trust over cost.

A focus on more esoteric transactions – Finseta focuses on what it refers to as more ‘esoteric’ transactions. These can either be between more obscure currency pairings, or when moving money out of challenging jurisdictions. Whilst these are more complex and require a greater level of oversight, they also generate higher margins, allowing Finseta to grow their take rate over the past few years.

Making compliance a strength – For most regular banks, compliance is seen as a necessary evil, and their approaches are generally automated and black and white. Finseta has looked to make compliance a strength, focusing on those customers that are underserved by traditional banks. By doing so, they are able to process transactions that traditional banks won’t touch and onboard customers in a fraction of the time.

Investment in value added services - Finseta’s agility allows it to react quickly to changes in customers’ requirements. The addition of multi-currency accounts, its new corporate card and the mass payments feature for businesses are all examples of Finseta responding to customer demands.

A large and growing end market

The global cross-border payments industry is on the cusp of a major transformation. According to FCX, total payment flows in 2024 were estimated at $194 trillion and are expected to reach $320 trillion by 2032. Looking at the below chart, we can see that the majority of the market is made up of ‘wholesale’ payments, mainly involving settlements between banks. Excluding this, the non-wholesale, or retail, segment of the market was $39.9tn in 2024 and is expected to reach $64.5tn by 2032. This growth is being driven by increasing levels of international trade, particularly with emerging countries, global e-commerce, and improvements in digital payments.

Despite the size of the market, it is an area that is ripe for disruption. The conventional model of cross-border transactions, which involves the use of multiple correspondent banking partners (e.g. bank A sends to bank B via bank C) is both slow and expensive. The World Bank reports that the average cost of sending $200 in 2023 was 6.2-6.3%, far above their 3% target; the costs are higher still in places like Africa or South Asia. In addition, the current model lacks transparency and creates challenges for those who don’t have the required relationships with larger banks.

The need to overhaul the current system has been high on the agenda for policymakers and financial institutions globally, who understand that the current system risks stunting economic development. The G20 roadmap, set out in 2020, aims to address the key challenges that currently exist relating to cost, speed, access and transparency. As part of this, the introduction of global standards such as ISO 20022 will help to standardise messaging, improving interoperability and reducing friction.

The current inefficiency is opening the door for newer, more advanced MTOs, to take market share. Where once cross border transactions would take days, in some cases they can now be handled instantly. Greater levels of competition between providers are also helping to drive down costs and improve service, which in turn will drive greater total payment volumes.

Operating in an area that the banks don’t want to touch

According to McKinsey, global transaction fee revenue in 2024 was roughly $278 billion, with the vast majority of this still controlled by the tier 1 banks. Their dominant position has been under attack in recent years, however, particularly in what is sometimes referred to as the ‘low value’ segment of the market.

The cross-border payment market can be split into four primary areas. The first, and by far the largest, is B2B payments, which make up approximately 97% of total payment flows. The other three areas are made up of B2C, C2B and C2C; if we also include lower value small business transactions, the total share of these four segments is between 8-10%. Whilst these areas combined are far smaller than the B2B market, they make up a disproportionately large share of global transaction fees, roughly 33%.

According to research from McKinsey, revenue margins on non-business transactions range from 1.3% to 3.1%, compared to just 0.1% for B2B transactions. These higher margins reflect the fact that these transactions are generally smaller and more complicated for MTOs. A number of new entrants have gained entry by focusing on particular payment routes or segments of the market, allowing them to easily undercut incumbent banks.

The proliferation of new providers has created a fractured and highly competitive landscape, but the size of the potential reward, and the negligence of the banks, means that there is significant potential for those who are able to get it right. There is also the potential for new entrants to use the ‘lower value’ market as a stepping stone to the much larger B2B market; a good example being Wise who have shifted focus from consumer to business transactions in recent years.

Finseta serves a combination of businesses and high net worth individuals, with a focus on larger and more complex transactions such as a business or property purchase. They are not alone in targeting this area of the market, with a number of competitors operating in the same space. Finseta management believes, however, that the competitive dynamic that matters in this scenario is not between them and other smaller MTOs, but between them and the banks.

Details on market share between fintechs and banks are murky due to the opaque nature of international transactions, but estimates suggest that banks control approximately 92% of B2B payments; this falls to 76% for SMEs specifically and significantly less in non B2B transfers. The trend away from traditional banks is expected to continue with a recent Citi Group survey of financial clients stating that 90% expected to lose over 10% of their cross-border payment business in the next 5-10 years.

The question here is why banks are not fighting harder to retain this business? From conversations with Finseta’s management, there is a general disbelief that this is the case, but legacy technology, slow and bureaucratic decision making, and the fact that it falls outside their core competencies are some of the reasons given for this.

The fact that banks serve a broader customer base also makes it difficult for them to tailor solutions to SMEs and individuals; for example, they may have minimum transaction amounts that are unsuitable for small businesses. Working with large B2Bs is also much more attractive for banks, they onboard once and then transact multiple times in large amounts; if we compare this to the nature of Finseta’s business, they might onboard once and then handle a single large transaction for a customer. For banks this is not worth the effort, nor are they set up to handle it.

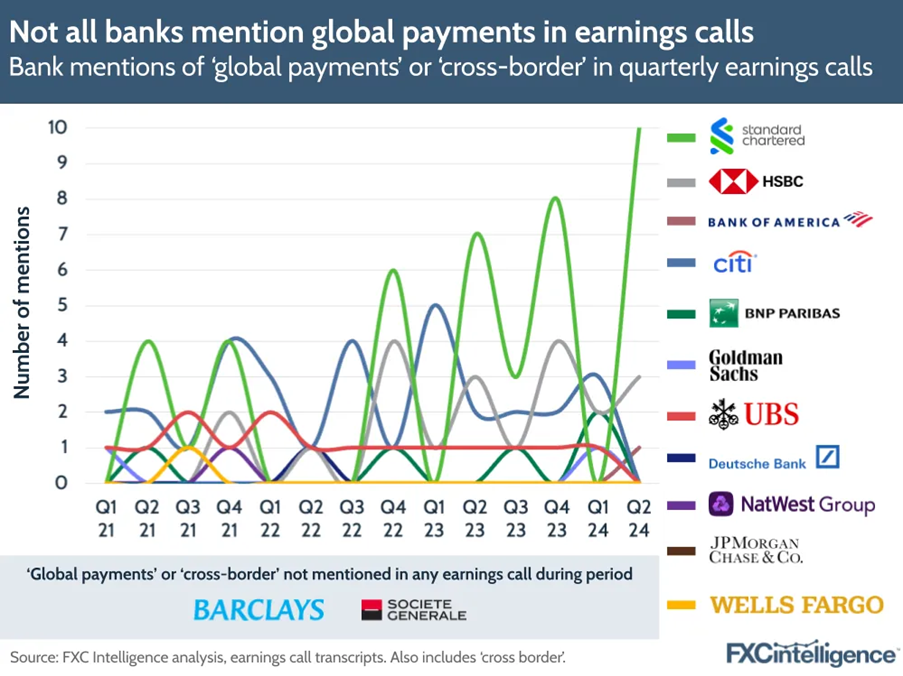

It is not simply a case of banks not caring, but sometimes they are unable to compete effectively; the recent high-profile failure of Zing, HSBC’s international transfer app, is a good example this. Attempts to retain or grow the larger B2B segment are harder to gauge, but the following research by FXC provides a useful proxy for the level of focus banks are placing on cross-border transactions. Of 13 banks researched by FCX, only 2 reported cross border payments separately, Citi and Standard Chartered. The below chart shows the number of mentions of global payments during earnings calls, with only three banks regularly mentioning them more than once.

Source: FCX Intelligence

The erosion of banks’ dominant position, particularly in the ‘low value’ segment of the market discussed above is likely to continue. Whilst fintechs currently have strong market shares in B2C, C2B and C2C, there is significant potential in the SME business market where smaller, more frequent transactions make them unattractive to larger banks. Companies like Finseta, who focus on a particular part of the market, are likely to continue to take market share from the larger banks who lack the necessary focus and incentive to defend their positions.

A unique approach to client acquisition

The standard model for customer acquisition in the FX industry involves cold calling potential clients. Finseta operates a very different model which relies instead on what it calls its introducer network. Essentially, they utilise a network of property agents, lawyers and accountants to recommend them to potential clients; given that these individuals are highly trusted and often present during situations when clients need to make large international transactions, it is an effective way for Finseta to win new clients.

The benefits of this to Finseta are two-fold. Firstly, it reduces the number of sales staff that are required. Finseta does still employ a sales team that reaches out to potential introducers, but it is not as large as would be required if they were running a direct outreach program. The second part is that it enables them to maintain higher margins on transactions; in this case we are referring to the take rate, or the mixture of fees and spread they earn on payments.

The introducer network’s effect on margin is primarily due to the different relationship it creates between Finseta and the client. Firstly, because of the size of the transactions, what matters to clients is trust, not necessarily cost. This is one of the reasons they are willing to accept recommendations from people they trust, such as an accountant or lawyer. Because these clients are recommended directly, Finseta doesn’t have to offer lower prices in order to win business or compete directly with other MTOs. This also allows Finseta to avoid comparison websites which would again drag them into price competition and lower take rates. This combination means that Finseta has a take rate of above 1%, well in excess of its larger competitors.

This is one of the aspects of the business that management believe is a key differentiator. It is unusual to see a payments business of this size that is already profitable and the higher take rate that Finseta earns is one of the key reasons for this.

High-touch customer experience

In an industry where the vast majority of players have moved to online only business models, Finseta has gone in the opposite direction. By focusing on providing a high level of customer service, they have been able to appeal to a different segment of the market and avoid direct competition with platform operators such as Wise.

As touched on above, the transactions that Finseta handles are large and often complicated from a regulatory standpoint. For this reason, clients often prefer to handle transactions over the phone rather than using an online platform. From conversations with HNWIs who have handled large international transfers recently, there is a reluctance to use online platforms such as Wise for these payments. Many resort to paying in tranches which means multiple fixed fees and therefore minimal savings compared to ‘high touch’ providers.

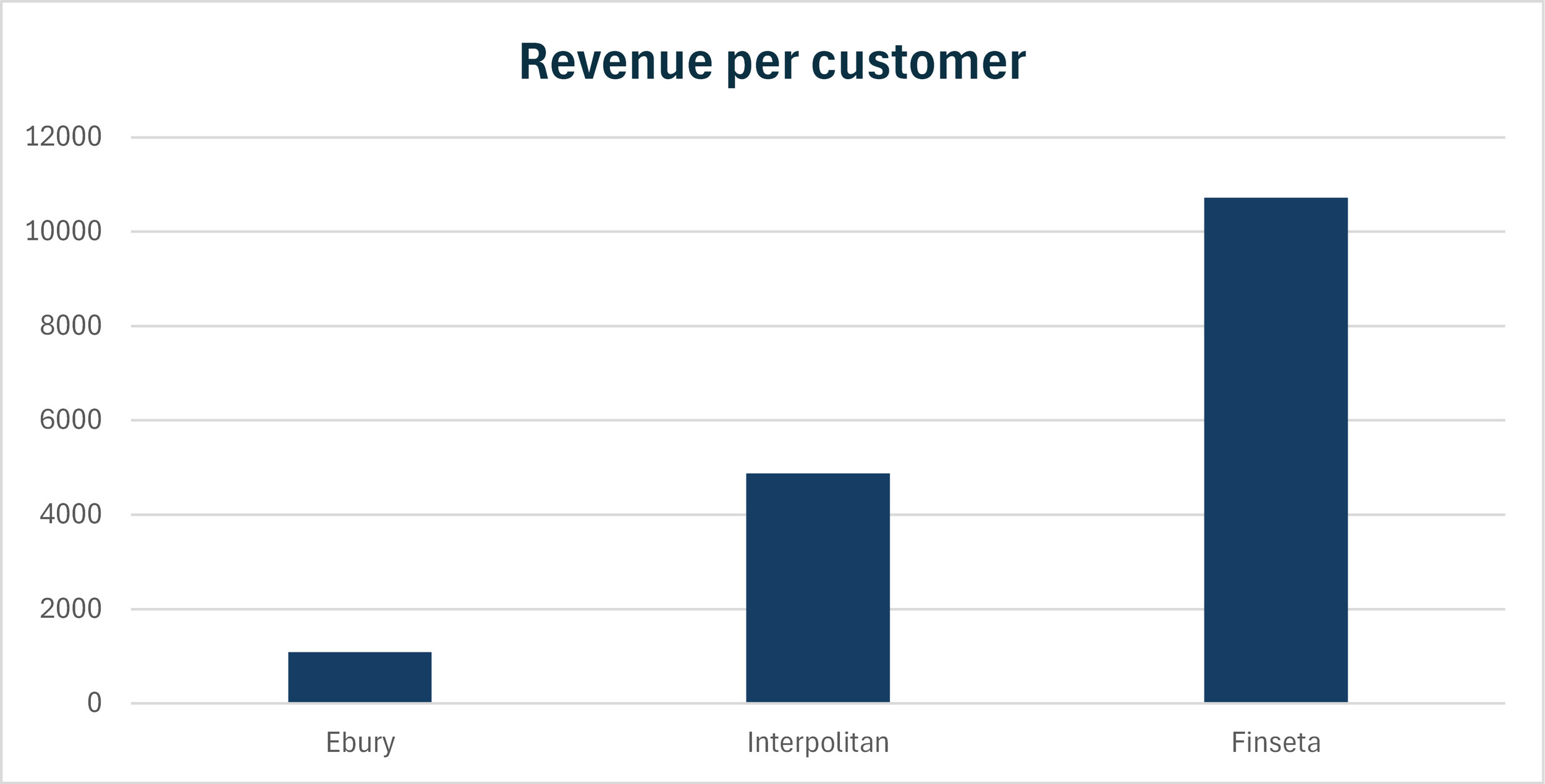

Every Finseta customer gets their own dedicated account manager and can handle transactions over the phone or using their proprietary platform. This flexibility is important to Finseta’s customers and is not something that most modern payments businesses offer. It also allows Finseta to increase their share of wallet by facilitating transactions of different sizes; a customer may be introduced to Finseta for a property purchase (handled over the phone) and then use them for future smaller transactions (using their online platform). Looking at the below chart, we can see this greater level of service reflected in the number of customers per employee for Finseta compared to two other MTOs, Interpolitan and Ebury.

The data uses Interpolitan and Finseta’s most recent results, Ebury uses 2015 numbers so that the businesses are similar sizes.

Finseta’s focus on customer service is not only important because it differentiates them from online only MTOs, but also because service is a key pain point for customers of traditional banks. As an example of this, it can sometimes take up to 6 months for a customer to be onboarded with a regular bank, Finseta does it in 24 hours. Finseta is able to offer a far greater level of service and still remain cheaper than most banks, by 5% on average. Whilst they are unlikely to be competitive on price with online only payments businesses, the focus on service means they are not in direct competition with these providers.

A focus on more ‘esoteric’ transactions

Finseta has carved out a niche by focusing on what it sometime refers to as more ‘esoteric’ transactions. These are either between less common currency pairs or when moving money out of challenging jurisdictions. Banks, in contrast, usually focus on the major currencies, such as USD, EUR, and GBP whose markets are usually far more liquid and where they already have trusted relationships with banking partners.

Transfers between more obscure currency pairings bring a host of challenges. Firstly, they require a greater number of correspondent banks to facilitate the transaction; this means higher costs, slower transfers and less visibility over payments. There are also greater levels of currency volatility, differences in payment systems and complicated regulatory environments, all of which require an MTO with specific market knowledge.

Finseta has looked to embrace this complexity and make it a strength for the business. The company has what it calls a solutions desk which focuses on more complicated transactions that require a greater level of staff input and oversight. They also have direct access to local clearing houses in locations like Asia Pacific and Latin America, places that were traditionally seen as very challenging to serve effectively.

This direct relationship with clearing houses is an important competitive advantage for the company. Firstly, it reduces the need for multiple correspondent banking partners, meaning transactions are faster and more cost effective. It also gives Finseta much more control over transfers, which in turn give customers greater transparency over their payments. Lastly, it is a barrier to entry for new companies; access to them requires sponsorship from a much larger bank, many of whom are now unwilling to continue offering this service because it provides very little benefit to them.

Many of the issues surrounding differences in payment systems and outdated technology are being solved within the market more generally. The introduction of ISO20022, which aims to standardise the messaging required for cross-border transactions, should help to reduce friction and improve both cost and payment times. Finseta should benefit from this, along with the rest of the industry.

We looked at take rate briefly above, but the esoteric nature of the transactions Finseta handles is another reason why their take rate is higher than some of their competitors and has expanded over the years. We saw above how Finseta had close to half the number of customers per employee, yet their revenue per employee is the second highest of the 5 competitors I looked at (IFX and 3S don’t publish customer numbers, so weren’t included in the previous chart).

Unfortunately, these companies don’t publish transaction volumes or any other useful non-financial metrics, but the revenue per customer gives some indication of the different nature of these businesses. Finseta’s higher take rate, driven by the complexity and size of the transactions it handles, allows it to offer a greater level of service than competitors and still maintain staffing costs that are lower than their peers.

Making compliance a strength

Compliance is another area where Finseta has looked to turn complexity to its advantage. Know your customer (KYC) checks are standard across the industry and are essential in preventing fraud and money laundering. Compliance requirements also vary depending on jurisdiction; capital controls, for example, still exist in countries such as China, and Australia has strict rules on disclosure around transactions sizes. These intricacies mean that those companies facilitating transactions within more obscure jurisdictions must have a strong understanding of the regulatory landscape in each of these locations.

In addition, banks have clearly laid out the type of customer they are looking for. This means that individuals or businesses who create even minimal compliance challenges are often rejected during the initial onboarding process. For individuals this can cover a broad range of customers who create challenges around effective KYC and in identifying the source of funds (a key component of anti-money laundering regulations). For businesses, a surprising number do not meet banks’ regulatory hurdles; management gave the example of Rolls Royce, whose involvement in defence manufacturing would make them unsuitable for some banks.

Banks’ compliance checks are often automatic and black and white, meaning customers like the ones above can be rejected automatically. For banks these customers are deemed not worth the risk, but for smaller companies such as Finseta they represent an attractive opportunity. Firstly, these customers are disillusioned with the incumbent players and therefore tend to be less focused on cost and more focussed on the service they receive. Secondly, complex compliance requirements are resource intensive and therefore unsuitable for banks and MTOs such as Wise whose business models rely on volume. Thirdly, they often require flexibility and judgement that do not fit with processes in larger banks or other MTOs.

Finseta has, according to their CEO, ‘over invested’ in compliance, so it is clear that they see this as a crucial part of their future success. Unlike banks, who have very rigid vetting processes, Finseta has a compliance team that is able to use their judgement when onboarding customers. They have also built compliance checks into their platform to ensure that requirements are met across the lifecycle of a transaction. We will look at risk at the end, but the nature of the transactions that Finseta handles for clients means that as long as compliance checks are done by the book, there is next to no additional risk that they are taking on by working with these customers.

Investment in value added services

Another advantage of Finseta’s size and agility is that it is able to react quickly to customers’ pain points and introduce new services or products to meet those needs. An example of this is the introduction of multi-currency accounts which solved the problem of customers having to manage multiple accounts across different currencies.

More recently they launched their new corporate card scheme which allows payment in 210 currencies. This allows customers to pay for business expenses within the Finseta ecosystem, further reducing the requirement for different accounts and allowing Finseta to expand their share of wallet and gain access to a high-margin and repeatable source of business. Finseta expects this to be a significant driver of growth from H2 25 onwards, so this could add meaningfully to revenue going forward.

The other area where the group has looked to invest is in its platform, with recent upgrades to the customer interface. They have also added mass payments functionality, particularly aimed at businesses who may need to pay overseas employees. This is another example of functionality that was requested by clients and that Finseta was able to implement quickly.

Risks & Concerns

Macro slowdown leading to lower transaction volumes – The current ‘stagflationary’ environment, combined with the risk of recession, could lead to lower overall transaction volumes in the market. This is something that has already hit Finseta when it missed market consensus estimates. There is a risk that this situation gets worse for them if the macro situation becomes protracted, but I believe the split nature of their business between personal and business clients provides some diversification. Additionally, payments businesses are relatively well protected during periods of high inflation because they earn their fees on the nominal transaction values.

Exodus of HNWIs from the UK – Whilst it could be possible to see this as a short-term driver of growth for the business, as wealthy homeowners sell their properties and look to repatriate the cash, there is no doubt that long-term this will be a headwind for the business. With London property no longer seen as a safe haven asset and the uncertainty created by the current government, wealthy individuals are unlikely to purchase properties in London, leading to lower transaction volumes for companies like Finseta.

Competition with other Fintechs – This one almost seems too obvious to include here, but given I have focused mainly on the relationship between Finseta and the larger banks, it feels important to mention it. Finseta operates in a crowded market with hundreds of other small MTOs. This is unlikely to be an issue in the short-term given the size of the overall market, its continued growth, and the opportunity to take further market share from banks, but as the industry matures there is likely to be greater competition between the smaller payment businesses.

The rise of stablecoins – Stablecoins are essentially cryptocurrencies whose value is pegged, normally on a 1-1 basis, with a fiat currency (usually the dollar). There has been real excitement in the cross-border payments space about their potential to improve speed, transparency and cost, issues currently associated with legacy payment rails. Whilst I think this will have a big impact on the industry, stablecoins currently have less than 1% market share and are therefore unlikely to compete with traditional rails for at least the next 5-10 years. There have also been mini crises for stablecoins, including TerraUSD decoupling from its USD peg in 2022 and Circle (a stablecoin company) holding its dollar reserves in SVB. When SVB collapsed there were questions about whether these would be guaranteed by the US government; ultimately the US did, but there was a ‘shadow run’ on the USDC stablecoin whose holders were worried they wouldn’t be able to redeem on a 1-1 basis. These issues would not be the same for a fiat currency backed by the central bank, and for that reason I still believe there is some way to go before we see a full transition to this technology.

The BIS’ recent annual economic report discusses stablecoins and their impact on the modern monetary system at some length. It names three key features of money that mean stablecoins are unable to serve the same purpose. The first is the singleness of money, or the knowledge that one dollar is worth one dollar. In a stablecoin system, even one where the value is pegged, they often trade at a discount to their peg value, reflecting the creditworthiness of the issuer. The second aspect the BIS mentions is elasticity. This refers to the ability of banks to expand their balance sheets, supported by their standing facility with central banks, allowing them to provide the liquidity required to settle large transactions or meet on-demand loan commitments. The final area mentioned relates to the integrity of the financial system. The current monetary system puts the onus on banks and financial institutions (like Finseta) to combat fraud and financial crimes. Stablecoins, which can move freely across borders and be hosted in anonymous wallets make them much harder to manage from a KYC standpoint and therefore an attractive form of payment for criminals and terrorist organisations. This undermines the likelihood that they will ever be seen as a credible form of payment.

A word on currency volatility…

Given the recent high-profile failure of Argentex, it is worth me explaining here why the same cannot happen for Finseta. Argentex was a currency hedging business that got into a liquidity crisis by accepting what are called zero-zero trades; essentially customers aren’t required to post any margin. When the recent tariff volatility caused their bank to ask them to post collateral, the nature of the trades means they couldn’t request margins from their customers.

Finseta, on the other hand, is a foreign currency payments business rather than an FX risk management business. This means that the vast majority of their transactions are spot, rather than forward (92% vs 8%). They are also not MIFID regulated, meaning that they are not authorised to trade more than a certain number of forward contracts. This significantly mitigates their level of exposure to currency market volatility. The small number of forward contracts that they do have are back-to-backed with a counterparty, so Finseta doesn’t carry any of that risk.

Valuation

Valuing smaller companies is much more challenging than larger ones. This is partly because there is often a shorter history of financials, but also because they are more sensitive to changes in assumptions. I have followed my usual model of forecasting under three separate scenarios, but because the business only began generating FCF during the last year, the bear case returns a negative equity value, and I have therefore decided to leave its probability as 0%. As you can see this investment still represents a positive NPP.

The base case here takes the FY25 guidance for revenue growth along with the H125 gross margin and then assumes that growth accelerates slightly over the next 3-5 years. The bull case is similar but assumes higher growth, peaking at about 24% in FY27, before coming back down; it also assumes some margin expansion to previous levels. Both of these scenarios return ROIC values for the forecast period that are below the levels seen during the past 3 years; I believe this reflects sensible assumptions over future fundamentals.

Conclusion

I have gone back and forth on this investment for a while now. I really like the company and the management, but I also think that the current macro environment is likely to be a really challenging backdrop for a payments company. Despite this, I believe a significant amount of this uncertainty is already priced in and therefore represents minimal downside risk based on the scenarios that I am forecasting. For this reason, I will take a small initial position in the company and then look to add to this down the line depending on how the scenario plays out.